Landscaping, Gardening and Plants Statistics in 2025

Last Updated: 24 April 2025

Statistics Outline

Landscaping Statistics 2025

In 2025, the landscaping industry is expected to experience substantial growth, reflecting ongoing trends in consumer preferences and economic factors. Here are key statistics and projections for the landscaping market in 2025:

1. Commercial landscaper’s 2025 goals include boosting revenue, gaining new clients, and improving operational efficiency.4

These goals reflect a strategic response to the evolving demands of the industry. As the landscaping market continues to grow, companies are recognizing the need to adapt their business models to remain competitive.

![]()

2. Landscape businesses source materials mainly from supply houses and nurseries, with a smaller

portion obtained directly from vendors.4

The reliance of landscape businesses on supply houses and nurseries for sourcing materials, with a smaller portion obtained directly from vendors, reflects the industry’s dynamics and the importance of building strong supplier relationships.

Market Statistics

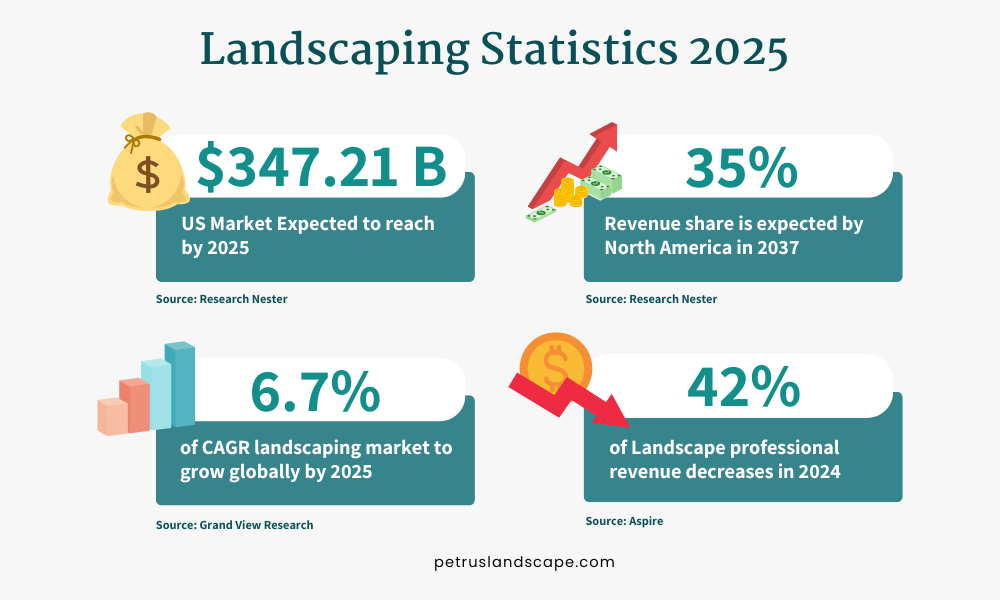

1. The U.S. landscaping market is projected to reach $347.21 billion by 2025.1

This growth signifies a robust demand for landscaping services as homeowners increasingly recognize the value of enhancing their outdoor spaces, reflecting a shift towards investing in property aesthetics.

2. Landscaping services market valued at $331.05 billion in 2024, projected to exceed $714.81 billion by 2037.1

The international expansion indicates that landscaping is becoming a global priority, driven by urbanization and the need for green spaces in both residential and commercial environments.

3. North America expected to dominate the market with over 35% revenue share by 2037.1

North America’s strong market presence highlights its established culture of home improvement and outdoor living, setting trends that may influence global practices.

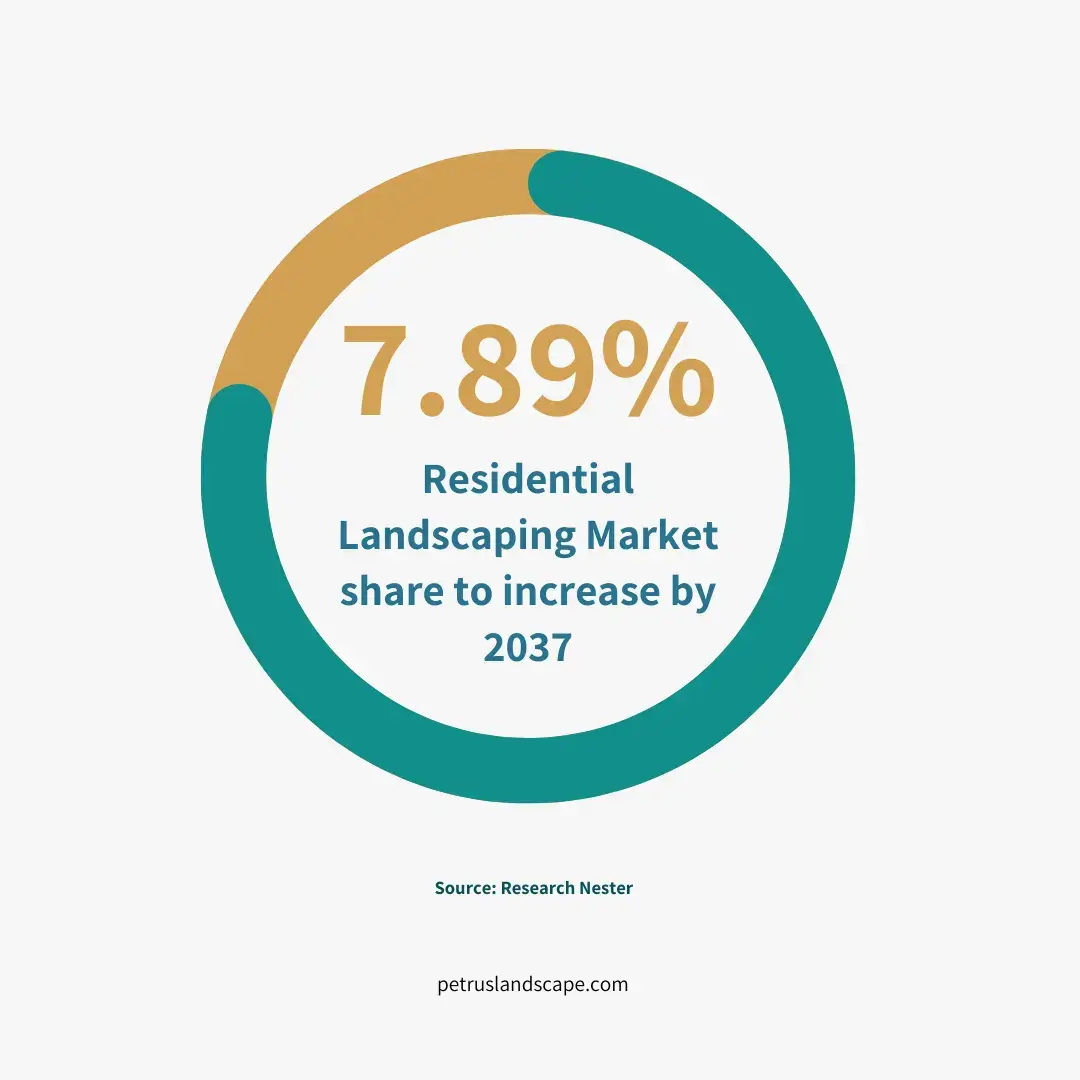

4. Residential landscaping segment to hold about 7.89% market share by 2037.1

This projection highlights the importance of residential clients within the broader landscaping market. As more homeowners invest in their outdoor spaces, this segment is likely to grow, providing opportunities for landscapers to expand their service offerings tailored to residential needs.

5. The global landscaping products market to grow at a CAGR of 6.7% from 2025 to 2030.3

Increased investment in quality materials reflects consumer desire for durable and aesthetically pleasing landscapes that require less frequent replacement or repair.

6. BrightView Holdings, Yellowstone Landscape, Gothic Landscape, Ruppert Landscape, and U.S. Lawns hold the largest market shares in the landscaping industry.2

The presence of these major players indicates a competitive landscape where established companies are likely to leverage economies of scale and brand recognition to capture significant market share. Their dominance may also influence industry standards and practices.

7. The mowing segment is expected to see significant growth in the landscaping services market in the coming years.1

As one of the most fundamental aspects of landscape maintenance, mowing services remain essential for residential and commercial properties alike. Increased focus on maintaining curb appeal will likely sustain demand for mowing services as property owners seek professional assistance.

8. The Landscaping Services industry saw a 0.2% growth in market size in 2023.5

While modest, this growth indicates resilience within the industry amid economic challenges such as inflation and labor shortages. It suggests that consumer interest in outdoor spaces remains strong despite external pressures.

9. The landscaping industry has grown at a 6.0% CAGR over the past five years, reaching $184.1 billion in 2025.11

Growth is driven by stable institutional clients and high-revenue commercial clients like hotels and resorts.

10. The landscaping industry is projected to reach $207.9 billion by 2030, growing at a CAGR of 2.5% over the next five years.11

This growth is driven by a steady rise in non-residential construction activity, making it a key focus area for landscapers.

11. The U.S. landscaping services market grew 3.0% in 2024, reaching an expected $189 billion, fueled by strong demand for outdoor living spaces and eco-friendly designs.12

This growth highlights how sustainability and lifestyle trends are reshaping the industry’s priorities.

Industry Challenges

1. 42% of landscape companies experienced revenue declines in 2024.4

The revenue declines reflecting the economic uncertainties that are affecting consumer spending. This trend highlights the need for businesses to adapt their strategies and focus on delivering value to clients.

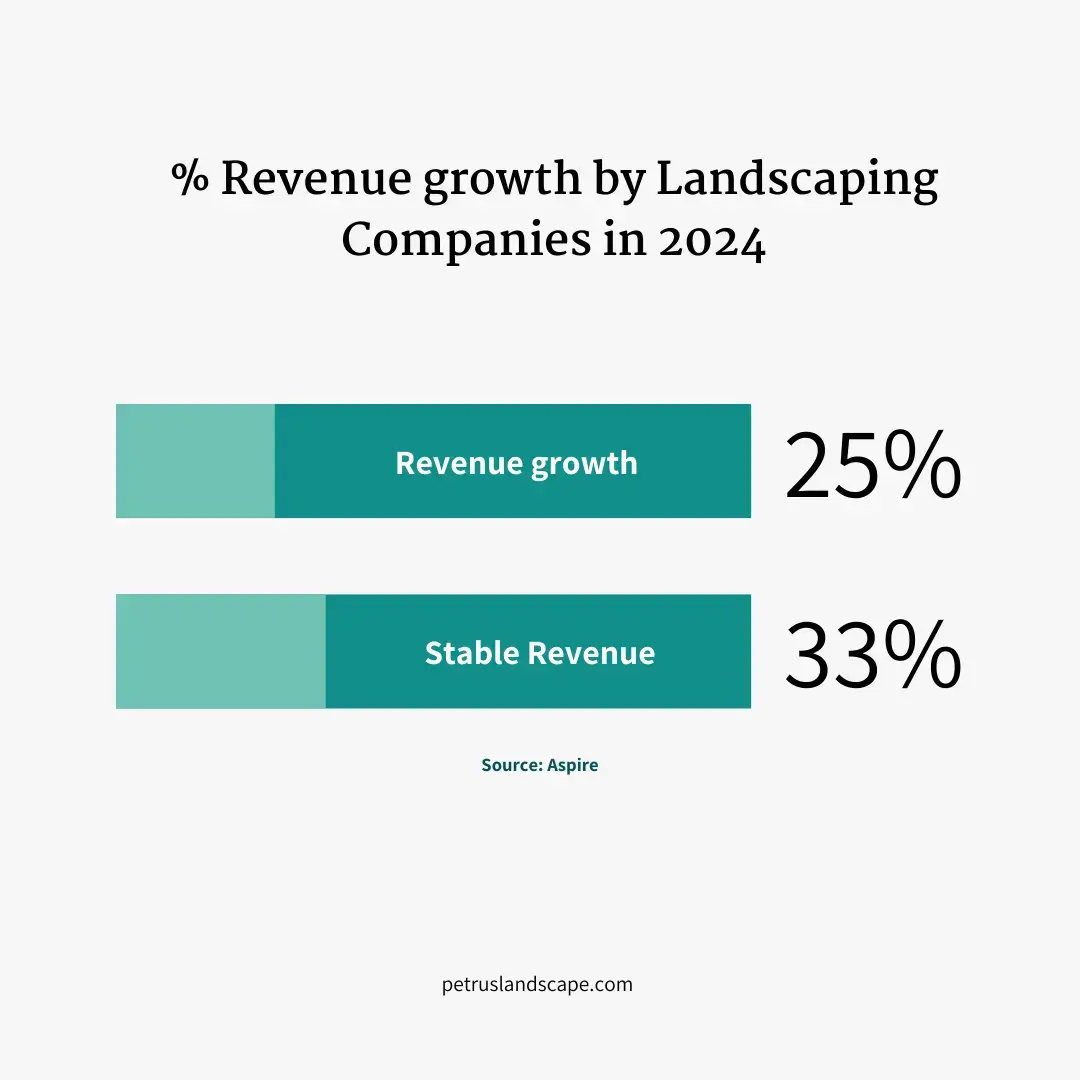

2. In 2024, only 25% of companies reported revenue growth, while 33% remained stable.4

The revenue distribution for landscape companies in 2024 paints a mixed picture of growth and challenges. While only 25% of businesses enjoyed increased revenue, likely due to innovative services or niche market focus, 33% maintained steady earnings, signaling resilience.

3. Landscapers are cautious about increasing competition by 34% in 2025.4

The cautious outlook of landscapers regarding a 34% increase in competition by 2025 highlights the evolving landscape of the industry. As the demand for landscaping services continues to grow, propelled by urbanization and a focus on sustainability, it’s crucial for landscaping professionals to adapt to this competitive environment.

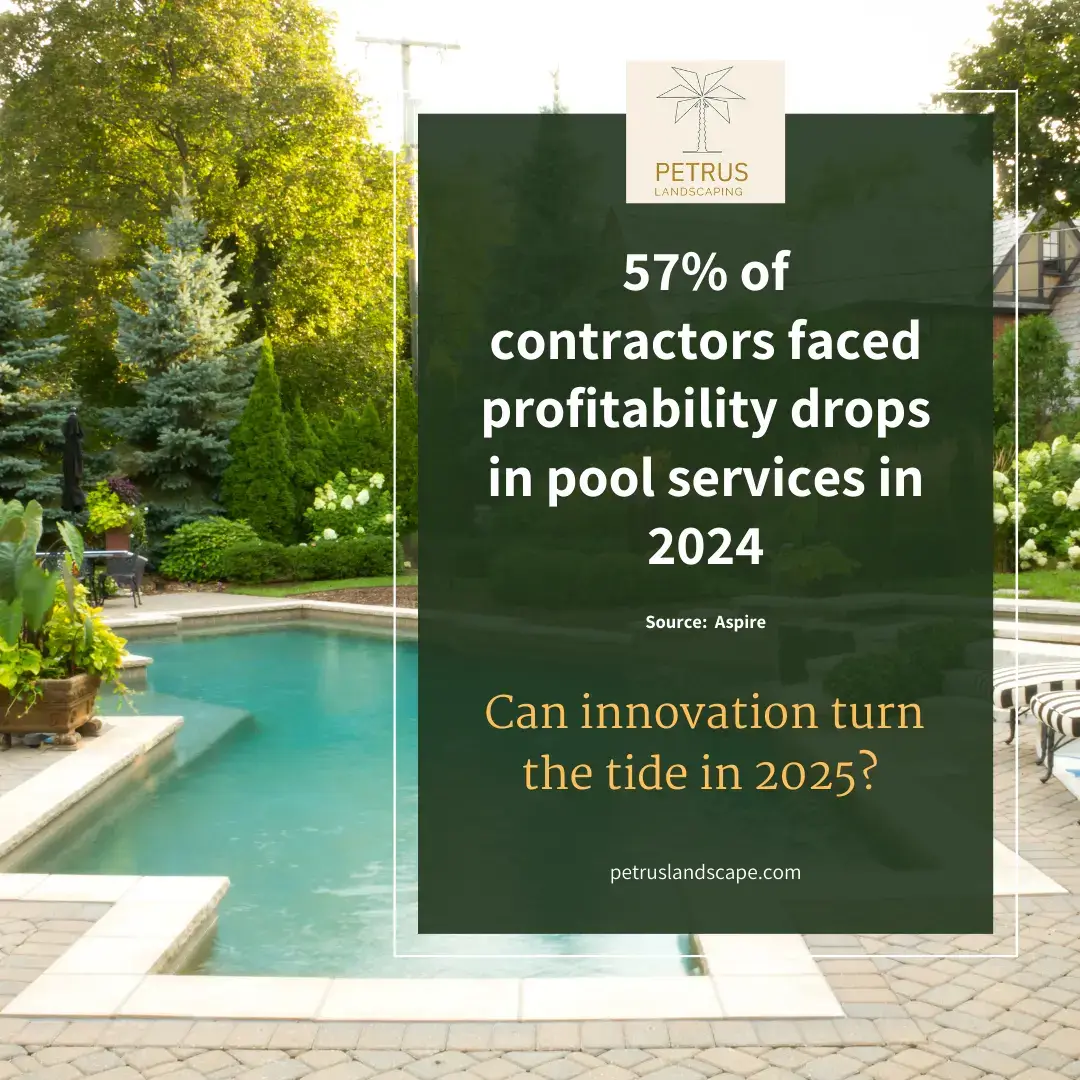

4. 57% of contractors reported a decrease in profitability for pool installation and maintenance services in 2024.4

The report indicating that 57% of contractors have experienced a decrease in profitability for pool installation and maintenance services highlights significant challenges within the industry. This decline can be attributed to several factors, including rising material costs, labor shortages, and increased competition.

Landscaping Trends

1. Rising demand for smart irrigation and robotic lawn care in North America.1

Technological advancements are revolutionizing traditional landscaping practices, allowing for more precise management of resources and improved service delivery.

2. Incorporating features like patios, decks, and professional landscaping can enhance a property’s appeal, potentially boosting its resale value by 10-20%.2

This statistic underscores the financial benefits of investing in landscaping enhancements. Homebuyers are increasingly looking for properties with attractive outdoor spaces, which can significantly influence their purchasing decisions. As such, homeowners may view landscaping as a valuable investment rather than just an expense.

3. Advanced design software and augmented reality tools are revolutionizing landscaping by streamlining project planning and enhancing execution.4

These technologies not only streamline project management but also enhance client engagement through visualizations that help them envision final outcomes.

4. Rapid urbanization in U.S. is driving demand for professional landscaping services.2

As cities grow denser, the need for well-designed landscapes becomes critical for enhancing quality of life and providing residents with accessible green areas.

5. The demand in U.S. for landscaping services in commercial sectors is rising due to increased investments in property aesthetics by businesses.2

Businesses recognize that attractive landscapes can enhance customer experience and improve brand image, leading to greater investment in professional services.

6. The Southeast U.S., especially Florida and Georgia, sees high landscaping demand due to rapid suburban and commercial development.11

Rising population and dense single-family housing areas continue to drive growth in landscaping services.

Revenue Insights

1. Landscape Maintenance services expected to account for around 50% of market share by 2037.1

Maintenance services are becoming increasingly vital as homeowners seek convenience and expertise in managing their outdoor spaces effectively.

2. TruGreen company generated $1.5 billion in revenue in 2023 and is set to grow to $2.5B annually.6 & 9

TruGreen’s substantial revenue highlights the potential profitability within the landscaping sector, particularly for companies that effectively market their services and build strong customer relationships.

3. In 2024, the landscape and garden maintenance sector accounted for 43.69% of the industry’s total revenue.2

This substantial share indicates that maintenance services are a cornerstone of the landscaping industry, reflecting ongoing consumer demand for regular upkeep of outdoor spaces. Homeowners recognize that well-maintained gardens and landscapes not only enhance aesthetic appeal but also contribute to property value retention.

4. 35% of revenue in landscaping services comes from loyal repeat customers.4

This data emphasizes the importance of customer retention in driving consistent revenue growth. Also highlights the value of maintaining strong relationships and offering services that keep clients coming back for more.

4. Landscapers’ profitability has remained strong despite rising chemical costs, averaging a profit margin of 11.9% in 2025.11

This highlights the industry’s ability to maintain margins amid increasing operational expenses.

Consumer Behavior

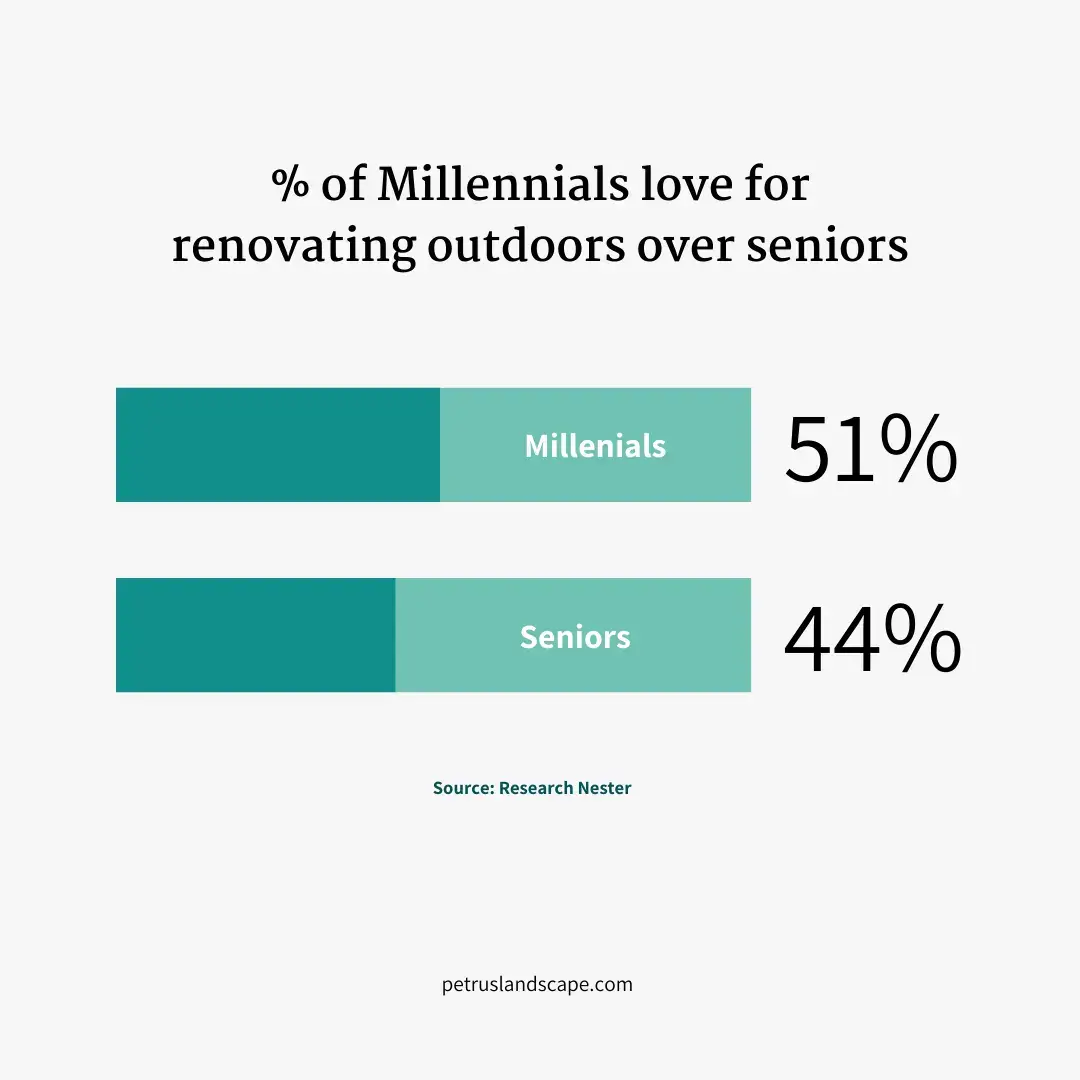

1. 51% of Millennials prefer renovating outdoor spaces, compared to 44% of seniors.1

This trend suggests that younger generations are placing a higher value on outdoor living spaces than older demographics. As Millennials continue to enter homeownership, their preferences will likely drive innovation and demand for modern landscaping solutions that cater to lifestyle enhancements.

2. Millennials and Gen Z drive trends in outdoor enhancements like fire pits and eco-friendly designs.3

This demographic shift towards outdoor enhancements reflects changing lifestyles where outdoor living areas are becoming extensions of indoor spaces. Their preference for eco-friendly options also signals a broader trend towards sustainability that landscapers should incorporate into their offerings.

Labor & Demographic Insights

1. The household landscaping segment is projected to grow at a compound annual growth rate (CAGR) of 7.0% between 2025 and 2030.2

This growth projection reflects increasing consumer interest in home improvement and outdoor aesthetics, driven by trends in outdoor living and gardening. As more homeowners seek to personalize their outdoor spaces, businesses in this sector can expect robust demand for their services.

2. 14% of landscapers intend to raise salaries by 4-5% in 2025.4

The intention of 14% of landscapers to raise salaries by 4-5% in 2025 reflects a strategic response to several important factors influencing the landscaping industry today.

3. The American Time Use Survey reveals that the average American spends 70 hours annually on lawn and garden care.10

This demonstrates the scale and importance of the landscaping industry in driving job growth and supporting local economies.

4. In 2023, the U.S. was home to 641,700 landscaping businesses, employing around 1.3 million people, according to the U.S. Bureau of Labor Statistics.10

This reflects the growing interest in maintaining outdoor spaces for relaxation and sustainability.

5. Over the past five years, the number of landscaping service businesses in the U.S. has steadily grown, averaging 5.5% growth per year from 2019 to 2024.11

The steady rise in landscaping businesses reflects a thriving market driven by growing demand for both residential and commercial outdoor services.

Environmental Impact

1. 20% – 40% of global crop production lost to pests annually estimated by National Institute of Food & Agriculture.1

This statistic emphasizes the importance of integrated pest management (IPM) practices within landscaping and agriculture. Effective pest control not only protects crops but also enhances landscape health, making it a critical area for landscapers to focus on sustainable practices.

Gardening Statistics 2025

Gardening Market Stats

1. The U.S. gardening market, valued at $22 billion, is expected to grow at a 4.5% CAGR from 2025 to 2030.7

This growth reflects a sustained interest in gardening as a hobby and an essential part of home improvement, indicating that consumers are increasingly investing in their outdoor spaces despite economic uncertainties.

2. Home Depot is the leading source for garden supplies (32.2%) and garden plants (33.9%).8

While national retailers dominate the market, this data underscores the importance of convenience and accessibility in consumer purchasing decisions, especially for those new to gardening.

3. Independent Garden Centers (IGCs) were cited as the highest quality source for garden plants by 30.3% of respondents, compared to 24.7% for Home Depot.8

This highlights that while large retailers are popular, many consumers value the expertise and specialized offerings found at local garden centers.

Time & Money Spent Gardening Statistics

1. Just 12.2% of respondents reported gardening less in 2024 compared to 2023.8

A relatively low percentage suggests that while some individuals may be reducing their gardening time, the majority remain engaged, highlighting a resilient interest in gardening as a fulfilling activity.

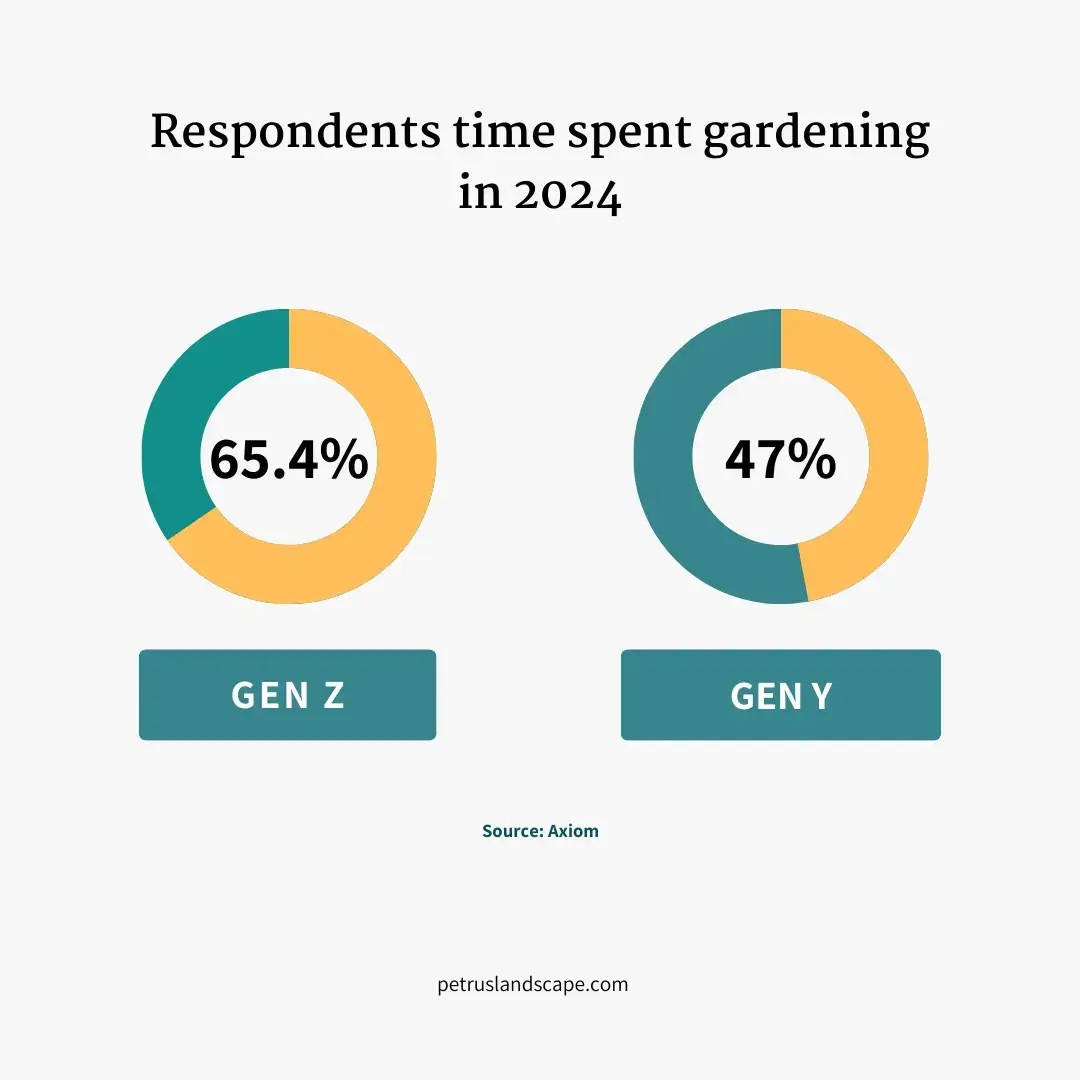

2. Gen Z (65.4%), Gen Y (47%), and male (43.4%) respondents spent more time gardening in 2024 than in 2023.8

This trend indicates that younger generations are not only embracing gardening but also prioritizing it as a meaningful way to connect with nature and contribute to sustainability.

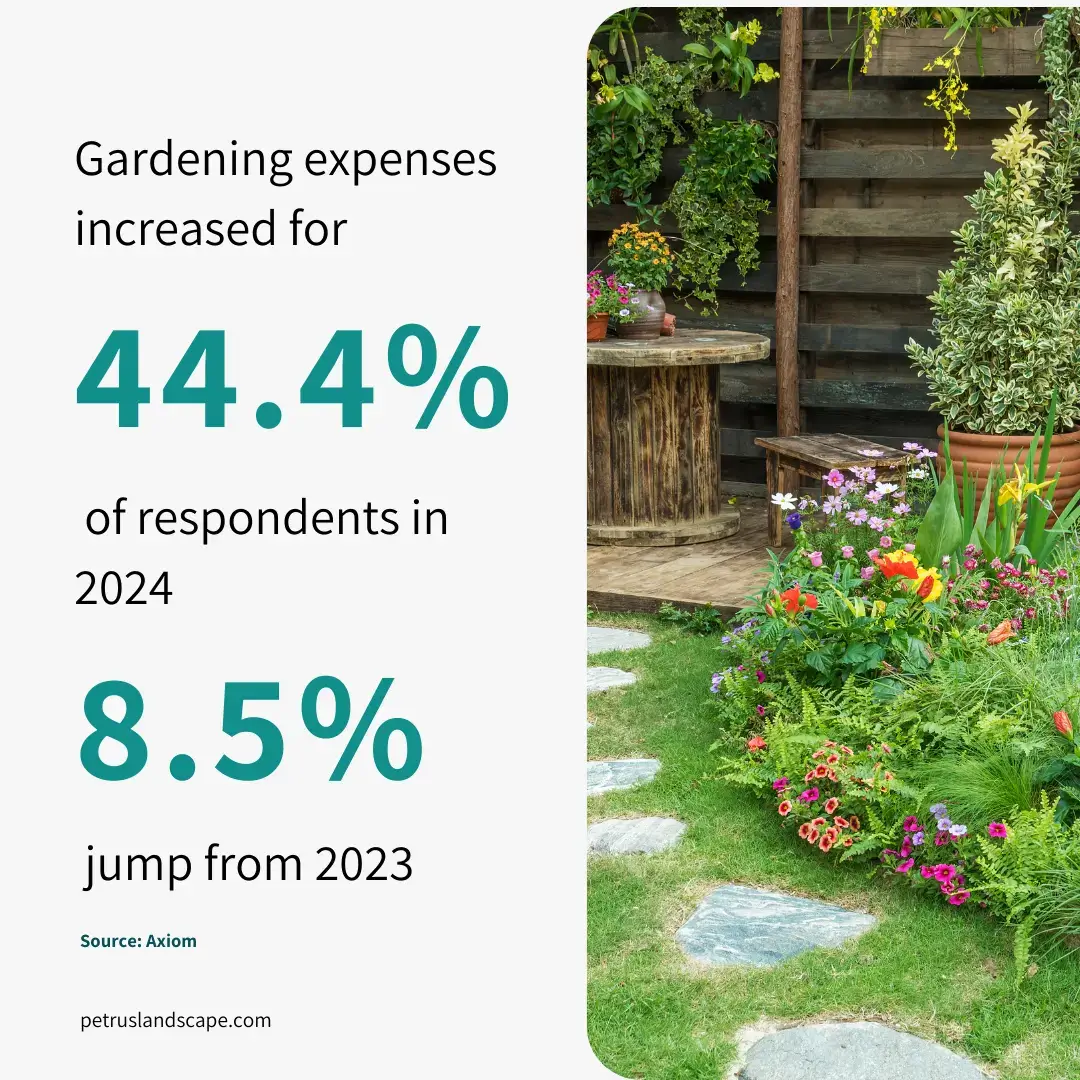

3. Gardening expenses increased for 44.4% of respondents, up by 8.5 points from 2023.8

An increase in spending shows that consumers are willing to invest more in their gardens, possibly due to the perceived benefits of home-grown produce and the therapeutic effects of gardening.

4. Time was the top barrier to gardening in 2024, followed by budget limitations.8

While interest remains high, time and money affect participation levels in gardening tasks.

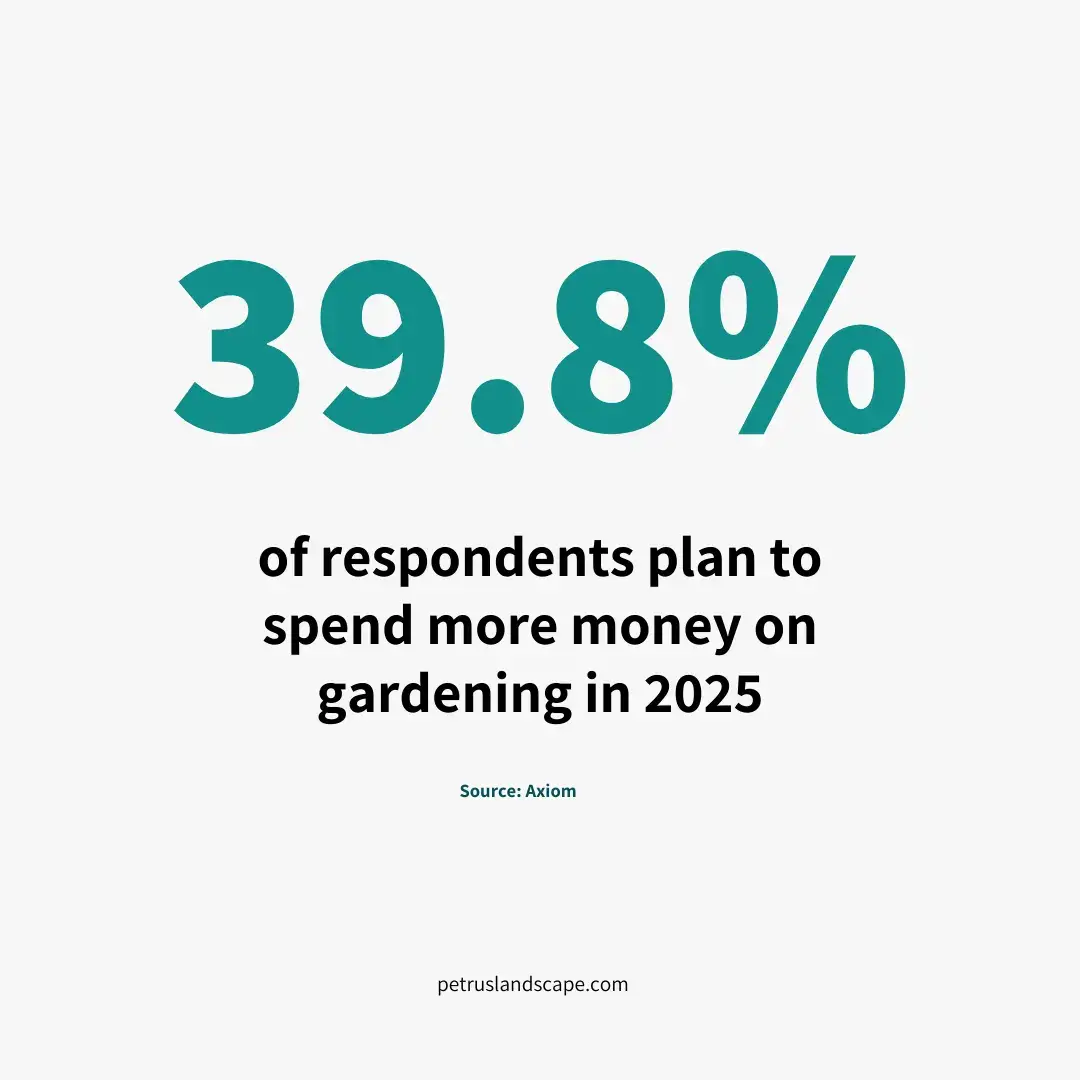

5. 39.8% of respondents plan to spend more on gardening in 2025.8

A significant portion of respondents (39.8%) plans to increase their gardening spending in 2025, signaling a growing interest in outdoor spaces.

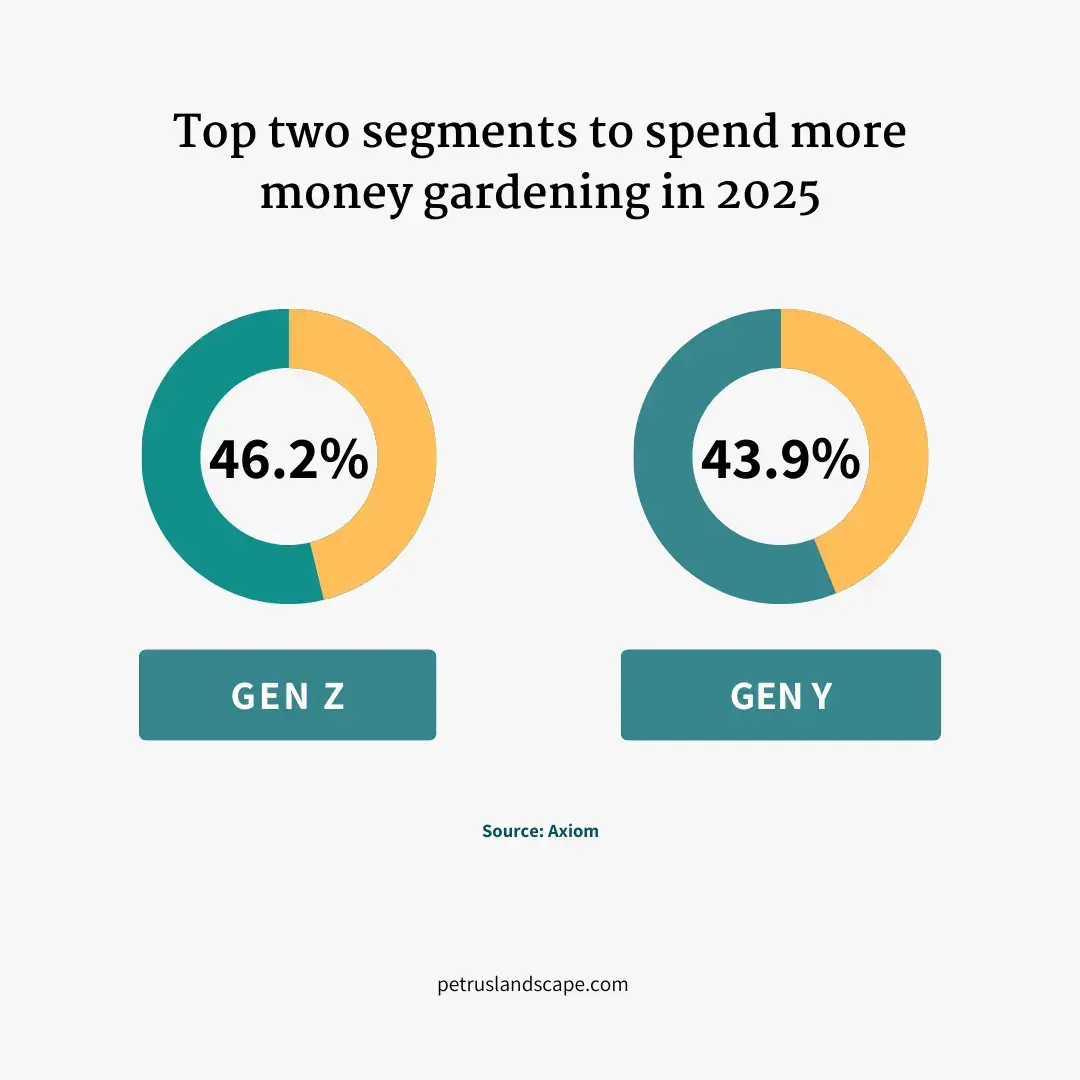

6. Gen Z (46.2%) and Gen Y (43.9%) are the top groups expecting to increase spending more money in 2025.8

This optimism among younger generations bodes well for the industry, indicating potential growth in demand for gardening products and services.

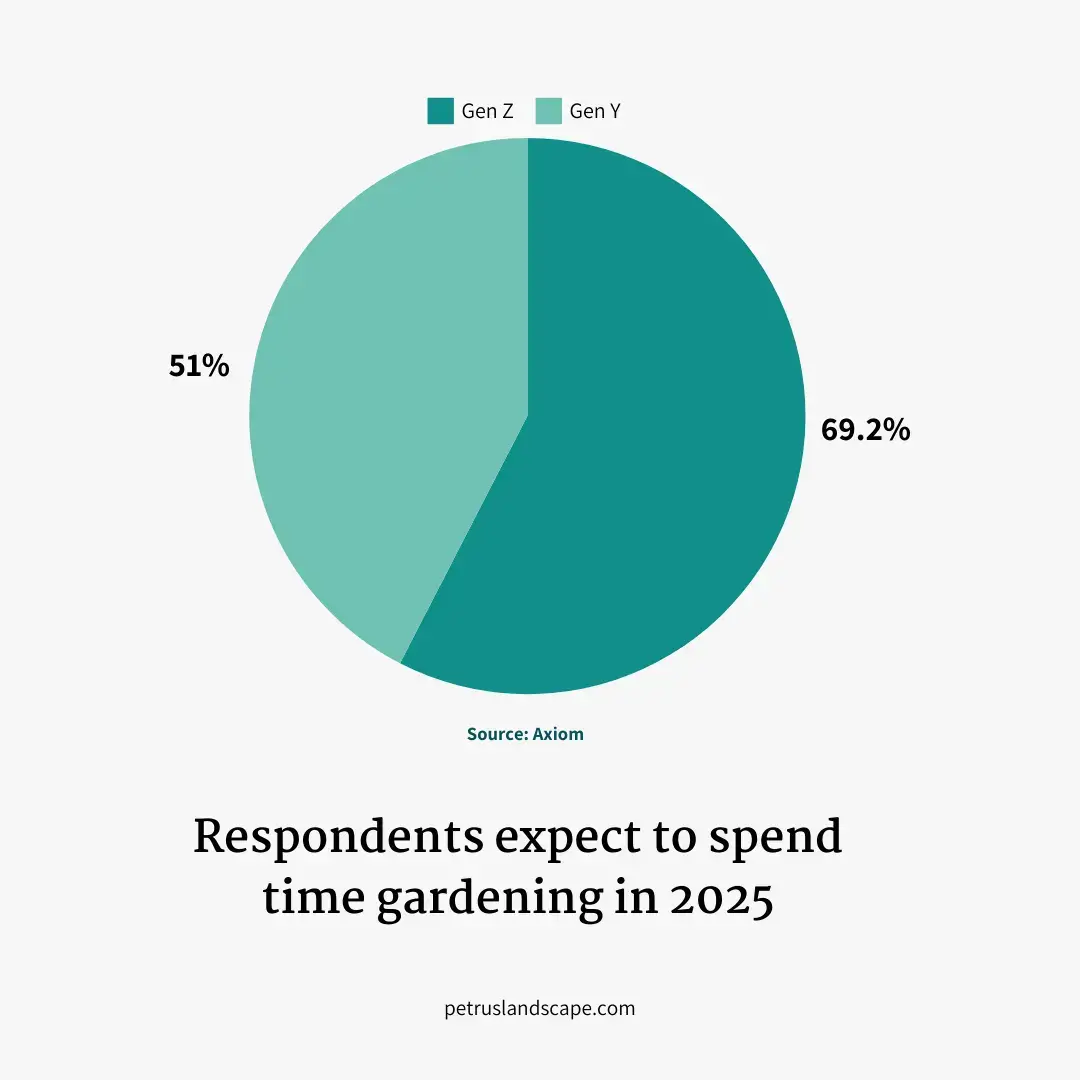

7. In 2025, Gen Z (69.2%) and Gen Y (51%) expect to invest more time in gardening.8

Gen Z and Gen Y’s anticipated more time in gardening reflects a commitment to making gardening a regular part of their lifestyles.

Gardening Trends

1. Top reasons for participation in gardening in 2024 were enjoying being outside (63.2%), liking to grow things (58.2%) & producing fresh fruit, vegetables, and herbs (53.3%).8

Above three reasons reflect a growing awareness of health and wellness benefits associated with gardening, as well as a desire for self-sufficiency.

2. In 2024, YouTube was the leading platform (38.5%) for gardening tips, surpassing Facebook and Instagram.8

This shows that visual content and tutorials are crucial for engaging new gardeners and providing them with practical advice.

3. Top gardening projects for 2025 include front plantings for curb appeal, vegetable gardens, and adding outdoor lighting.8

This showcases how gardeners are looking to improve both their homes and their self-sufficiency through gardening.

Plant Statistics 2025

As we move into 2025, planting trends highlight significant shifts in gardening preferences and behaviors. Enthusiasm for expanding green spaces continues, with many gardeners prioritizing home-grown produce, vibrant blooms, and sustainable practices.

1. About 55.9% of respondents plan to expand their gardens in 2025, though this is a decrease from 2023.8

The data indicating that 55.9% of respondents plan to expand their gardens in 2025, despite a decrease from previous years, reflects a continued interest in gardening as a rewarding activity. This trend suggests that, even amid challenges, many individuals still recognize the benefits of cultivating their own green spaces.

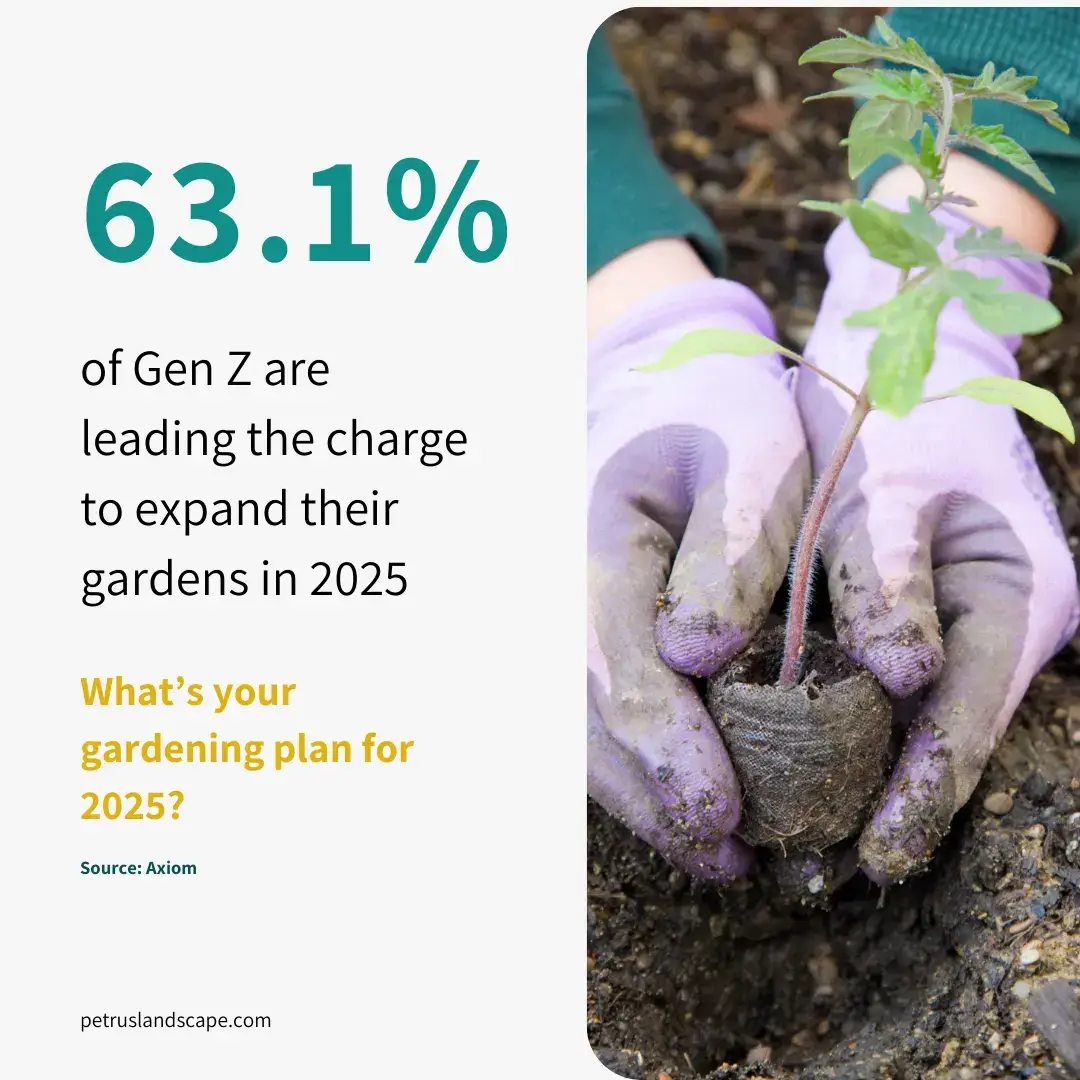

2. Gen Z (63.1%) and male (59.8%) respondents are the most likely to plant more.8

Notably, Gen Z (63.1%) and male respondents (59.8%) are leading the charge in garden expansion, highlighting a shift in demographics that may influence gardening trends and preferences. This younger generation’s enthusiasm for gardening could be driven by a desire for sustainability, self-sufficiency, and a connection to nature.

3. Nearly 74.1% felt successful in their 2024 gardening efforts.8

The fact that nearly 74.1% felt successful in their 2024 gardening efforts is encouraging, indicating that many gardeners are achieving their goals and finding satisfaction in their endeavors.

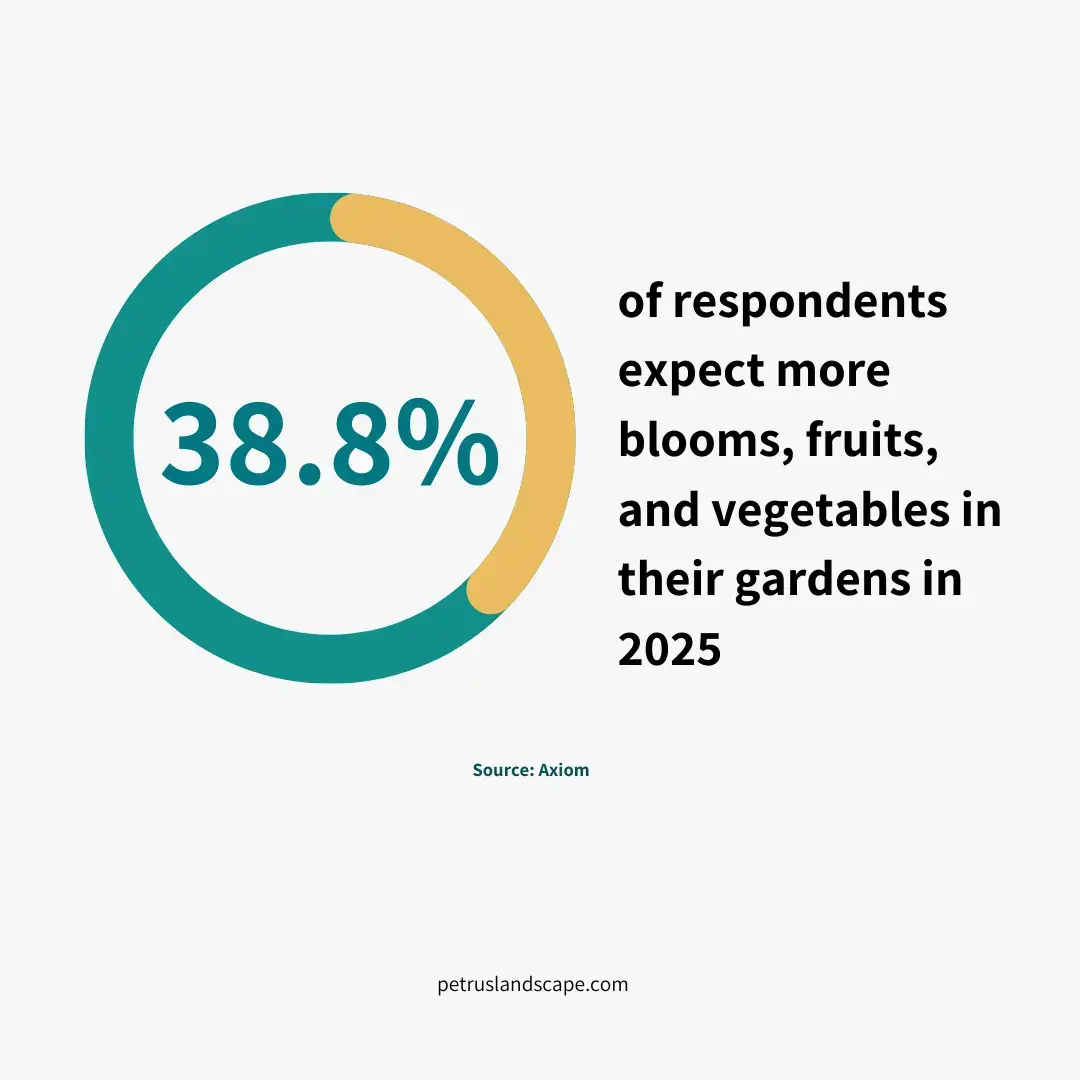

4. Over 38.8% of respondent desire more blooms, fruits, and vegetables in their gardens.8

The desire for more blooms, fruits, and vegetables expressed by 38.8% of respondents suggests that there is room for growth and improvement in garden productivity. This desire could lead to increased interest in learning about advanced gardening techniques, such as companion planting or organic gardening methods.

Market Statistics

- The U.S. landscaping services market is projected to reach approximately $347.21 billion in 2025.1

This growth signifies a robust demand for landscaping services as homeowners increasingly recognize the value of enhancing their outdoor spaces, reflecting a shift towards investing in property aesthetics. - The landscaping services market was valued at $331.05 billion in 2024 and is expected to exceed $714.81 billion by 2037.1

The international expansion indicates that landscaping is becoming a global priority, driven by urbanization and the need for green spaces in both residential and commercial environments. - Growing trend towards sustainable landscaping practices, with many consumers opting for organic gardening methods.1

This trend reflects a broader cultural shift towards sustainability, where consumers prioritize eco-friendly practices that contribute to healthier ecosystems. - Rapid urbanization is driving demand for aesthetically pleasing outdoor spaces.2

As cities grow denser, the need for well-designed landscapes becomes critical for enhancing quality of life and providing residents with accessible green areas. - Adoption of smart irrigation systems and robotic lawn care tools is expected to surge.1

Technological advancements are revolutionizing traditional landscaping practices, allowing for more precise management of resources and improved service delivery. - North America is expected to dominate the landscaping services market, accounting for over 35% of the global revenue share by 2037.1

North America’s strong market presence highlights its established culture of home improvement and outdoor living, setting trends that may influence global practices. - The demand for landscaping services in commercial sectors is rising due to increased investments in property aesthetics by businesses.2

Businesses recognize that attractive landscapes can enhance customer experience and improve brand image, leading to greater investment in professional services. - Landscape maintenance is projected to account for around 50% of the landscaping services market share by 2037, driven by consumer preferences for upkeep services.1

Maintenance services are becoming increasingly vital as homeowners seek convenience and expertise in managing their outdoor spaces effectively. - Various government initiatives aimed at enhancing urban green spaces are expected to boost demand for professional landscaping services.1

Public policies promoting green infrastructure can create new opportunities for landscapers while contributing positively to community well-being. - Innovations like advanced landscape design software and augmented reality tools are transforming how landscaping projects are planned and executed.1 & 2

These technologies not only streamline project management but also enhance client engagement through visualizations that help them envision final outcomes. - The global landscaping products market is projected to grow at a CAGR of about 6.7% from 2025 to 2030.3

Increased investment in quality materials reflects consumer desire for durable and aesthetically pleasing landscapes that require less frequent replacement or repair. - An increasing number of consumers prefer hiring professional gardening services over DIY approaches.1 & 2

This shift highlights the value placed on professional expertise as well as convenience, suggesting a growing market for service providers who can deliver quality results efficiently. - By 2037, the global landscaping services market is expected to exceed USD 714 billion.1

This long-term projection suggests that investments made today will pay off significantly as global trends continue favoring enhanced outdoor environments that prioritize sustainability and aesthetic appeal. - Landscape professionals experienced 42% of revenue decrease in 2024. 4

This decline highlights the need for businesses to innovate by adopting sustainable practices and diversifying services to meet shifting consumer preferences. - In 2024, only 25% of landscape companies enjoyed increased revenue, while 33% reported consistent earnings and 42% faced declines.4

The revenue distribution for landscape companies in 2024 paints a mixed picture of growth and challenges. While only 25% of businesses enjoyed increased revenue, likely due to innovative services or niche market focus, 33% maintained steady earnings, signaling resilience. In 2024, the landscape and garden maintenance sector accounted for 43.69% of the industry’s total revenue.2

This substantial share indicates that maintenance services are a cornerstone of the landscaping industry, reflecting ongoing consumer demand for regular upkeep of outdoor spaces. Homeowners recognize that well-maintained gardens and landscapes not only enhance aesthetic appeal but also contribute to property value retention.Incorporating features like patios, decks, and professional landscaping can enhance a property’s appeal, potentially boosting its resale value by 10-20%.2

This statistic underscores the financial benefits of investing in landscaping enhancements. Homebuyers are increasingly looking for properties with attractive outdoor spaces, which can significantly influence their purchasing decisions. As such, homeowners may view landscaping as a valuable investment rather than just an expense.The household landscaping segment is projected to grow at a compound annual growth rate (CAGR) of 7.0% between 2025 and 2030.2

This growth projection reflects increasing consumer interest in home improvement and outdoor aesthetics, driven by trends in outdoor living and gardening. As more homeowners seek to personalize their outdoor spaces, businesses in this sector can expect robust demand for their services.Some leading companies like BrightView Holdings, Inc., Yellowstone Landscape, Gothic Landscape, Inc., Ruppert Landscape, and U.S. Lawns collectively hold the largest market share of the landscaping market.2

The presence of these major players indicates a competitive landscape where established companies are likely to leverage economies of scale and brand recognition to capture significant market share. Their dominance may also influence industry standards and practices.Demand for landscaping services peaks in spring and summer but typically drops in the winter months.1

Understanding seasonal demand patterns is crucial for landscaping businesses as they plan their workforce and marketing strategies. Companies may need to diversify their offerings or focus on winter services, such as snow removal or holiday lighting, to maintain revenue during off-peak seasons.The residential sector is projected to hold approximately 7.89% of the landscaping services market share by 2037.1

This projection highlights the importance of residential clients within the broader landscaping market. As more homeowners invest in their outdoor spaces, this segment is likely to grow, providing opportunities for landscapers to expand their service offerings tailored to residential needs.Nearly 51% of Millennials in the U.S. prefer renovating their outdoor spaces, compared to about 44% of seniors.1

This trend suggests that younger generations are placing a higher value on outdoor living spaces than older demographics. As Millennials continue to enter homeownership, their preferences will likely drive innovation and demand for modern landscaping solutions that cater to lifestyle enhancements.The mowing segment is expected to see significant growth in the landscaping services market in the coming years.1

As one of the most fundamental aspects of landscape maintenance, mowing services remain essential for residential and commercial properties alike. Increased focus on maintaining curb appeal will likely sustain demand for mowing services as property owners seek professional assistance.The National Institute of Food & Agriculture estimates that 20% to 40% of global crop production is lost annually due to pests.1

This statistic emphasizes the importance of integrated pest management (IPM) practices within landscaping and agriculture. Effective pest control not only protects crops but also enhances landscape health, making it a critical area for landscapers to focus on sustainable practices.The Landscaping Services industry saw a 0.2% growth in market size in 2023.5

While modest, this growth indicates resilience within the industry amid economic challenges such as inflation and labor shortages. It suggests that consumer interest in outdoor spaces remains strong despite external pressures.Millennials and Gen Z, are increasingly focused on enhancing outdoor spaces with patios, decks, and fire pits while embracing eco-friendly practices.3

This demographic shift towards outdoor enhancements reflects changing lifestyles where outdoor living areas are becoming extensions of indoor spaces. Their preference for eco-friendly options also signals a broader trend towards sustainability that landscapers should incorporate into their offerings.According to the 2023 National Gardening Survey, 33% of respondents expected to increase their spending on gardening and lawn products in 2023 compared to 2022.3

This anticipated increase in spending indicates a strong consumer commitment to gardening and lawn care, suggesting potential growth opportunities for businesses offering related products and services.TruGreen company generated $1.5 billion in revenue in 2023.6

TruGreen’s substantial revenue highlights the potential profitability within the landscaping sector, particularly for companies that effectively market their services and build strong customer relationships.

- The U.S. landscaping services market is projected to reach approximately $347.21 billion in 2025.1

References

- “Landscaping Services Market Size, Growth Report 2037.” Research Nester.

https://www.researchnester.com/reports/landscaping-services-market/6029 - “Landscaping Service Market Size And Share Report, 2030.” Grand View Research.

https://www.grandviewresearch.com/industry-analysis/landscaping-services-market-report - “Landscaping Products Market Size, Industry Report, 2030.” Grand View Research.

https://www.grandviewresearch.com/industry-analysis/landscaping-products-market - “2025 Landscape Industry Report.” Aspire.

https://www.youraspire.com/guides/2025-landscape-industry-trends-report - “Landscaping Services in the US – Market Size (2005–2030)” IBIS World.

https://www.ibisworld.com/industry-statistics/market-size/landscaping-services-united-states/ - “Landscaping services in the U.S. – statistics & facts.” Statista.

https://www.statista.com/topics/4798/landscaping-services-in-the-us/ - “US Gardening Market Size, Share & Trend 2030.” MarkNtel Advisors.

https://www.marknteladvisors.com/research-library/us-gardening-market.html - “2025 Axiom Gardening Outlook Study.” Axiom.

https://axiomcom.com/2025-gardening-outlook-study/ - https://growjo.com/company/TruGreen#revenue-financials

- https://www.bls.gov/

- “Landscaping Services in the US – Market Research Report (2015-2030)” IBIS World

https://www.ibisworld.com/united-states/industry/landscaping-services/1497/ - “Landscaping Services in the US – Market Size (2004–2031)” IBIS World

https://www.ibisworld.com/industry-statistics/market-size/landscaping-services-united-states/