Landscaping, Gardening and Plants Statistics in 2026

Last Updated: 03 December 2025

Landscaping, Gardening, Plants Statistics 2026

The landscaping industry continues to show steady momentum heading into 2026, driven by increased investment in outdoor environments and sustainable design solutions. With the market expanding and technology transforming service delivery, 2026 is shaping up to be a pivotal year for landscaping growth and innovation.

Market Statistics

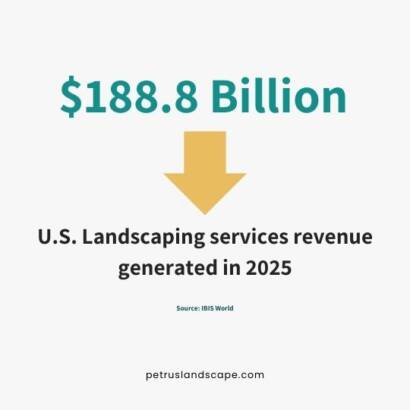

1. U.S. landscaping services revenue is estimated at about $188.8 billion in 2025.4

This figure highlights just how essential landscaping has become to both residential and commercial property value. The industry’s size shows strong, ongoing demand for outdoor improvements and maintenance services.

2. Landscaping services industry revenue grew roughly 6.5% annually between 2020 and 2025.4

A growth rate this steady signals a healthy, expanding market. It reflects homeowners’ rising interest in outdoor upgrades and the broader trend toward home-centric lifestyles.

3. The global garden seeds market is expected to rise from about $3.7B in 2025 to nearly $5.4B by 2035.3

This long-term increase points to steady consumer interest in gardening and food sustainability. Growth in seed demand also reflects a global shift toward homegrown produce and hobby gardening.

4. U.S. landscaping services is expected to exceed $200B by 2030.6

Breaking the $200B mark suggests the industry is entering a new era of higher spending and premium outdoor improvements. Strong housing activity and increased appreciation for outdoor living are major drivers.

5. The U.S. lawn care market is about $293B in 2024, forecast to grow 5.4% annually through 2033.8

This shows lawn care is one of the most resilient segments, consistently supported by recurring services. The long-term growth outlook indicates stable demand from homeowners and commercial clients.

6. The U.S. lawn & garden consumables market is about $22.92B in 2024 with a 6.2% CAGR forecast to 2034.9

This growth projection highlights ongoing spending on soil, fertilizers, plant foods, and related essentials. It also suggests more people are maintaining or expanding their gardens.

7. The U.S. landscaping industry 2024 value is around $182.76M with about 3.9% CAGR projected to 2033.10

Although smaller than the broader landscaping industry, this specific segment shows steady, dependable growth. New builds and renovations continue to fuel service demand.

8. In 2024, the global market for landscaping products reached about $88.64B.5

This valuation reflects strong global interest in beautifying outdoor spaces. Rising disposable incomes and outdoor entertainment trends are key contributors.

9. By 2030, the landscaping products market is expected to hit ~$129.98B with a 6.7% CAGR.5

This rapid growth shows how product innovation—from smart irrigation to eco-friendly materials—is reshaping the industry. Consumers are willing to invest in higher-quality outdoor features.

10. In 2024, North America held the largest share at about 34.6%.5

The region’s dominance highlights the high landscaping budgets typical of U.S. homeowners. Strong real estate markets and outdoor living culture play major roles.

11. The global landscaping market is valued at $344.78B in 2025, rising to $362.16B in 2026.19

This year-over-year increase reflects stable global interest in outdoor improvements. Even modest growth at this scale signals major economic momentum.

Businesses, Employment, and Labor Statistics

1. There are roughly 696,000–700,000 landscaping businesses in the U.S. as of 2024.11

This huge number shows how accessible and competitive the landscaping business is. It also reflects diverse service offerings ranging from basic lawn care to high-end design.

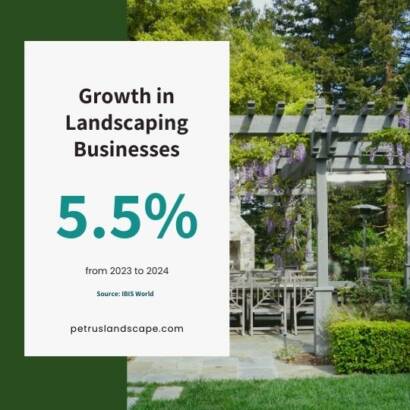

2. Landscaping business count rose about 5.5% from 2023 to 2024.11

New entrepreneurs continue entering the industry, drawn by strong demand. This expansion also shows confidence in the long-term viability of landscaping services.

3. About 85% of landscaping and lawn care workers are male.12

The gender imbalance highlights an opportunity for more diversity within the industry. Increasing female participation could bring new perspectives and innovation.

4. Nearly 1.5 million people worked in U.S. landscaping services in 2025.17

This large workforce underlines how vital landscaping is to local economies. Seasonal peaks and year-round service needs support millions of jobs.

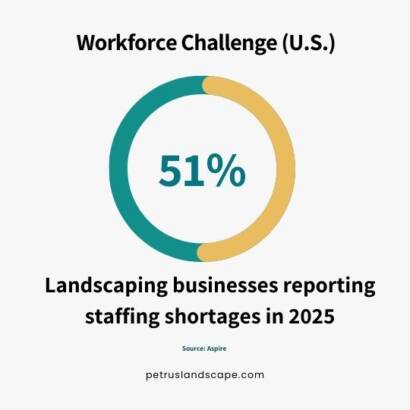

5. In 2025, 51% of landscaping businesses cited staffing shortages as a major risk.18

Labor challenges remain one of the industry’s biggest obstacles. Businesses are increasingly turning to automation and seasonal hiring strategies to compensate.

Customers, Spending, and Demand Statistics

1. U.S. homeowners spend about $300 per month on landscaping on average.13

This shows that landscaping is now considered a regular household expense rather than an occasional luxury. Consistent spending supports strong recurring-service models.

2. Homeowners spend about 70 hours a year maintaining their lawns.12

A commitment of this size shows how important lawn aesthetics are to many Americans. It also explains the growing demand for professional help.

3. Urbanization and higher population density are increasing demand for green spaces.10

Cities are prioritizing greenery to improve livability and mental health. This trend benefits both public landscaping projects and private-sector contractors.

4. Curb appeal and outdoor living remain key reasons homeowners invest in landscaping.8

Homebuyers value attractive, functional outdoor spaces more than ever. Outdoor kitchens, patios, and plant design play major roles in property value.

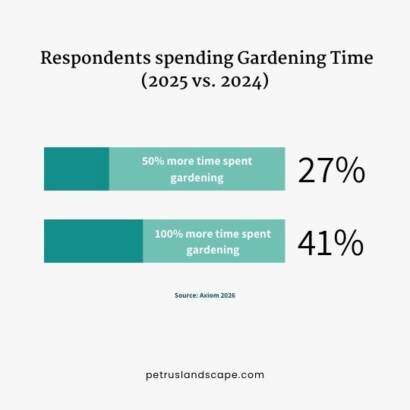

5. In 2025, the number of people spending 50% more time gardening rose by 27% vs. 2024.20

This rapid increase shows how gardening is becoming a core lifestyle activity. Many people use it as a stress reliever and a way to reconnect with nature.

6. 41% increase in people spending 100% more gardening time (2025 vs 2024).20

This jump indicates a deepening passion among gardeners. The trend aligns with growing interest in sustainability and at-home food production.

7. In 2025, 49.5% spent more money on gardening—an 11.5% increase from 2024.20

Rising budgets reflect greater enthusiasm and a willingness to invest in quality plants and tools. Retailers and nurseries benefit directly from this uptick.

8. 42.8% expect to spend more on gardening in 2026.20

Future spending expectations show sustained momentum in the gardening trend. This is a positive sign for suppliers and landscaping companies.

9. About 50.2% expect to spend more time gardening in 2026.20

This indicates gardening will remain a key hobby for many households. Growing time investment often correlates with increased product purchases.

10. In 2025, Gen Y (66.7%) and Gen Z (63.8%) spent more time gardening than Gen X (33.1%).20

Younger generations are embracing gardening at a surprisingly strong rate. Social media, wellness trends, and DIY culture contribute heavily.

11. For 2026, Gen Y (66.7%) and Gen Z (65.2%) expect to increase time gardening; only 37.2% of Gen X plan to.20

Younger consumers continue driving the gardening market forward. This generational shift suggests long-term market strength.

12. In 2025, 61.1% of Gen Y and 53.6% of Gen Z increased gardening budgets, versus 43% of Gen X.20

This reflects higher discretionary spending among younger adults when it comes to hobbies and home aesthetics. Companies targeting these groups may see faster growth.

13. For 2026, 63.9% of Gen Y and 49.3% of Gen Z plan to invest more, while only 31.4% of Gen X will.20

The continuing gap signals young gardeners as the primary growth engine of the industry. Brands catering to their tastes will remain competitive.

Landscaping Services and Segments Statistics

1. U.S. landscaping services reached about $178B in 2024.1

This confirms landscaping as a major segment of the home-improvement economy. Consumer interest in outdoor design continues to fuel the market.

2. Design-build and installation services are expected to grow 8.8% CAGR by 2030.14

Large projects like patios, water features, and hardscaping are becoming more popular. Homeowners increasingly seek full-service transformations.

3. California is a dominant state market for landscaping.10

Its climate, population, and continuous construction activity create fertile ground for the industry. Water-smart landscaping is especially important there.

4. Sun Belt states like Florida, Texas, and California show strong demand.15

Warm climates and booming housing markets keep landscaping contractors busy year-round. Outdoor living culture is much stronger in these states.

5. About 61% of the landscaping market comes from residential properties.14

Most demand originates from homeowners rather than commercial clients. This emphasizes the influence of suburban development and home upgrades.

6. Landscape & garden design/construction expected to grow 7.4% CAGR (2025–2030).15

High growth indicates rising interest in long-term, premium outdoor upgrades. Stylish and functional outdoor spaces remain a priority for many households.

Technology and Sustainability Statistics

1. Smart irrigation systems and automated watering are becoming more common.7&9

These technologies help homeowners save water and reduce maintenance time. Sustainability and convenience are the main selling points.

2. Drones, 3D models, and AI design software are improving landscape design accuracy.14

Technology is helping landscapers deliver more customized and efficient results. Clients appreciate visual previews and faster planning.

3. Sustainable landscaping practices are key growth drivers.14

Consumers increasingly prefer native plants, water-efficient designs, and soil-healthy solutions. Eco-friendly offerings can set businesses apart.

4. Smart landscaping with sensors and IoT devices is rising.14

These tools allow homeowners to monitor soil, moisture, and plant health in real time. This trend reflects the merging of technology with home improvement.

Industry Structure and Leading Players Statistics

1. BrightView, TruGreen, and Davey Tree remain major industry leaders.14

Their scale enables them to offer nationwide service and advanced technologies. Smaller companies often look to these leaders for industry direction.

2. North America leads in vegetable and herb seed demand.2

This is driven by widespread home gardening and interest in fresh, homegrown produce. Raised-bed gardening especially contributes to seed demand.

Gardening and Plants Statistics

1. The U.S. has an estimated 40–50 million acres of residential lawns.11

This massive footprint underscores the cultural importance of lawns in the U.S. It also demonstrates why lawn care is such a large industry.

2. In Feb 2025, drought conditions impacted 58% of California and Nevada.13

Drought pressure is pushing homeowners toward water-efficient landscaping. Xeriscaping and drought-tolerant plants are becoming more popular.

3. More homeowners are choosing meditation gardens, edible landscapes, and shaded areas.13

These trends show that outdoor spaces are being designed for wellness and functionality. Modern yards now serve as extensions of living spaces.

4. 63.6% of gardeners plan to expand gardens and plant more in 2026.20

Garden expansion shows strong confidence and enthusiasm among hobbyists. It indicates retailers can expect increased demand next year.

5. In 2025, specific plant variety influenced 36% of buyers.20

Consumers are becoming more selective in plant types, focusing on aesthetic and performance traits. Nurseries must offer more variety to stay competitive.

6. 77% said they would pay more for a preferred flower color or plant variety.20

This willingness to pay extra shows emotional and personal preference plays a major role. Specialty or rare plant varieties can capture premium pricing.

References

- “Landscaping services in the U.S. – statistics & facts” Statista 2025.

https://www.statista.com/topics/4798/landscaping-services-in-the-us/ - “2026 State of the Commercial Landscape Industry: Key Findings and Actionable Strategies.” Aspire 2025.

https://www.youraspire.com/blog/landscape-industry-insights-report - “Garden Seeds – Top Global Industry Trends in 2026” openPR 2025.

https://www.openpr.com/news/4275458/garden-seeds-top-global-industry-trends-in-2026 - “Landscaping Services in the US – Market Research Report (2015-2030)” IBIS World 2025.

https://www.ibisworld.com/united-states/industry/landscaping-services/1497/ - “Landscaping Products Market (2025 – 2030)” Grand View Research 2024.

https://www.grandviewresearch.com/industry-analysis/landscaping-products-market - “U.S. Landscaping Services Market Size & Outlook, 2022-2030.” Grand View Research 2022.

https://www.grandviewresearch.com/horizon/outlook/landscaping-services-market/united-states - “Lawn Care Industry Statistics and Trends for 2025.” SiteRecon 2025.

https://order.siterecon.ai/blog/lawn-care-industry-statistics-and-trends-for-2025 - “United States Lawn Care Market Size, Share, Trends and Forecast by Products and Services, Application, and Region, 2025-203.” imarc 2024.

https://www.imarcgroup.com/united-states-lawn-care-market - “Lawn and Garden Consumables Market Size and Forecast 2025 to 2034.” Predenece Research 2025.

https://www.precedenceresearch.com/lawn-and-garden-consumables-market - “USA Landscaping Industry 2025 to Grow at 3.89 CAGR with 182.76 Million Market Size: Analysis and Forecasts 2033” Data Insights Market 2025.

https://www.datainsightsmarket.com/reports/usa-landscaping-industry-693# - ” Landscaping Services in the US – Number of Businesses (2005–2031) ” IBIS World 2025.

https://www.ibisworld.com/united-states/number-of-businesses/landscaping-services/1497/ - “Lawn Care and Landscaping Industry Statistics.” LawnStarter 2025.

https://www.lawnstarter.com/blog/statistics/lawn-care-and-landscaping-industry-statistics/ - “How Much Does Lawn Care Cost? [2025 Data]” Angi 2025.

https://www.angi.com/articles/lawn-care-cost.htm - “United States Landscaping Market Size & Share Analysis – Growth Trends And Forecast (2025 – 2030)” Morder Intelligence 2025.

https://www.mordorintelligence.com/industry-reports/united-states-landscaping-market - “North America The US Landscaping Services Market Size 2026 | Digital Trends, Smart Solutions & AI 2033” LinkedIn 2025.

https://www.linkedin.com/pulse/north-america-us-landscaping-services-market-size-kdjfe/ - “Landscaping Service Market (2025 – 2030)” Grand View Research.

https://www.grandviewresearch.com/industry-analysis/landscaping-services-market-report - “Top Landscaping Industry Statistics [2025]” Aspire 2025.

https://www.youraspire.com/blog/landscaping-industry-statistics - “2025 Landscape Industry Report: Defining where technology meets opportunity” Aspire 2025.

https://www.youraspire.com/guides/2025-landscape-industry-trends-report - “Landscaping Services Market Outlook” Research Nester 2025.

https://www.researchnester.com/reports/landscaping-services-market/6029 - “2026 Gardening Outlook Study” Axiom 2025.

https://axiomcom.com/2026-gardening-outlook-study/